SAVE MONEY AUTOMATICALLY AND EARN 4.00% APY‡

Earn 4.00% APY‡ on balances up to and including $100,000 when you qualify.

Benefits You’ll Love

- High dividends every month you qualify

- Establish CCU membership

- No minimum balance requirements

- Provides access to highly competitive deposit and loan rates

- Unlock membership benefits with a Capitol CU Savings Account

- Links to free Kasasa Cash Back®, Kasasa Cash®, or Kasasa Play® checking

- 4.00% APY‡ on balances up to and including $100,000

- Up to 2.00% APY on balances over $100,000 depending on balance in account‡

- 0.05% APY‡ if qualifications are not met on Kasasa checking

- No minimum balance to earn rewards

- No monthly maintenance fees

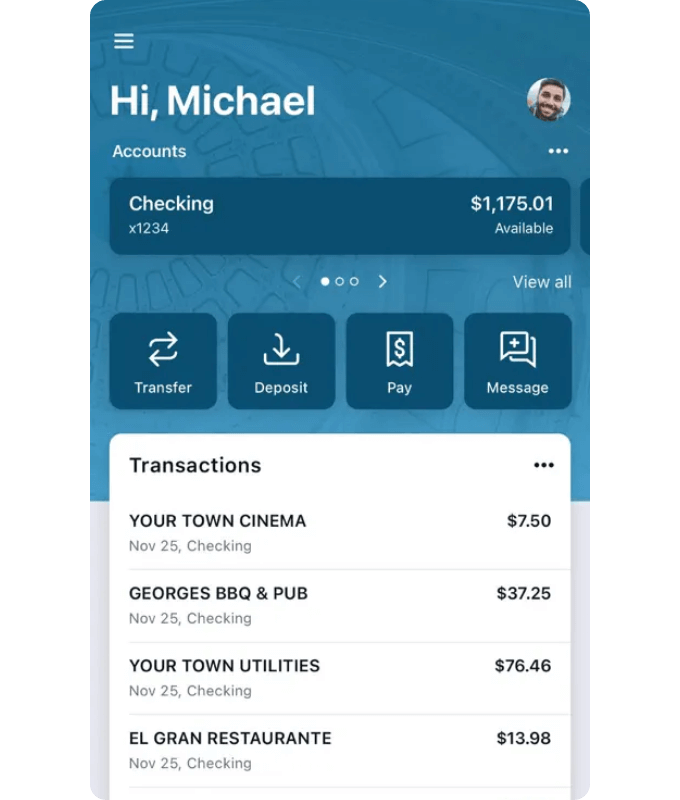

- Free online banking and bill pay

- Free e-statements

- Free mobile banking with mobile deposit

- Free telephone banking

- Free Visa® ATM card

- Access to surcharge-free ATMs across Texas

- $25 minimum deposit to open

{{ kasasa-saver-rate }}

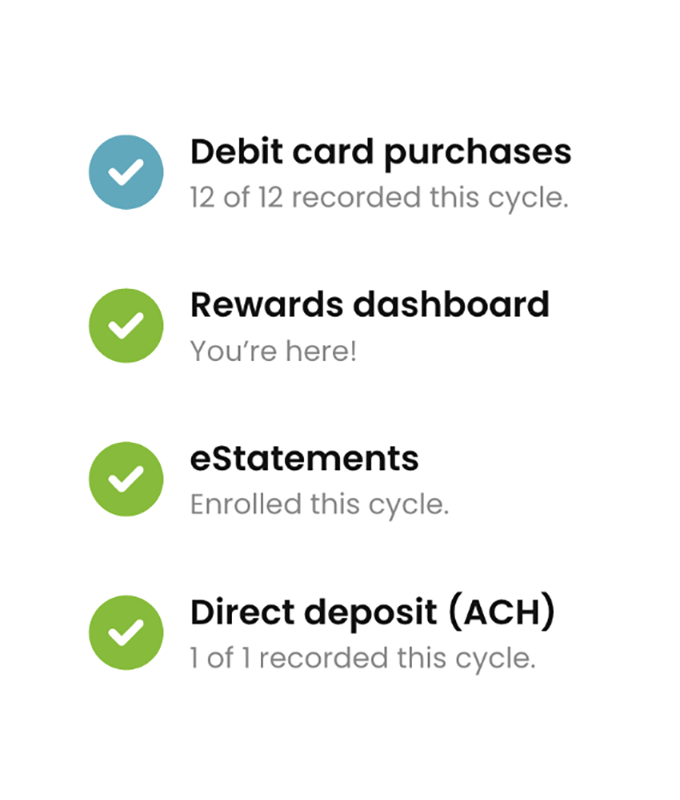

‡Qualification Information: Account transactions and activities may take one or more days to post and settle to the account and all must do so during the Monthly Qualification Cycle in order to qualify for the account’s rewards. The following activities do not count toward earning account rewards: ATM-processed transactions, transfers between accounts, debit card purchases processed by merchants and received by our credit union as ATM transactions, non-retail payment transactions, and purchases made with debit cards not issued by our credit union. Transactions bundled together by merchants and received by our institution as a single transaction count as a single transaction for the purpose of earning account rewards. “Monthly Qualification Cycle” means a period beginning one (1) business day prior to the first day of the current statement cycle through one (1) business day prior to the close of the current statement cycle. Reward Information: When your Kasasa Cash Back account qualifications are met during a Monthly Qualification Cycle, the following rewards will be distributed to your account(s) on the last day of the current statement cycle: Kasasa Saver: Balances up to $100,000.00 receive APY of 0.50%; and balances over $100,000.00 earn 1.982% interest rate on the portion of balance over $100,000.00, resulting in a range from 1.25% to 4.00% APY depending on the account’s balance. Kasasa Cash Back: 4.00% cash back on up to a total of $300.00 PIN-based/signature-based debit card purchases that post and settle to the account during that cycle period.  You will also receive reimbursements up to an aggregate total of $15.00, max. $4.00 per single transaction for nationwide ATM withdrawal fees imposed by other financial institutions and incurred during the Monthly Qualification Cycle in which you qualified. An ATM receipt must be presented for reimbursements of individual ATM withdrawal fees of $4.01 or higher. We reimburse ATM withdrawal fees based on estimates when the withdrawal information we receive does not identify the ATM fee. If you have not received an appropriate reimbursement, we will adjust the reimbursement amount if we receive the transaction receipt within sixty (60) calendar days of the withdrawal transaction. A maximum of $6.00 cash back may be earned per Monthly Qualification Cycle. When Kasasa Cash Back qualifications are not met, Kasasa Saver: All balances earn 0.05% APY. Kasasa Cash Back: No cash back payments are made. APY = Annual Percentage Yield. APYs accurate as of 07/01/2023. Rates and rewards are variable and may change after account is opened. Fees may reduce earnings. Additional Information: Account approval, conditions, qualifications, limits, timeframes, enrollments, log-ons and other requirements apply. $25 minimum deposit is required to open the account. Enrollment in electronic services (e.g., online banking, electronic statements, and log-ons) may be required to meet some of the account’s qualifications. Monthly Direct Deposit/ACH credit and / or debit is a qualifier for this account. Limit 1 account per social security number / individual taxpayer identification number.  A linked Kasasa Saver account is required for automatic savings. There are no recurring monthly service charges or fees to open or close this account. Contact one of our credit union service representatives for additional information, details, restrictions, processing limitations and enrollment instructions.  Federally insured by NCUA. Kasasa, Kasasa Cash Back and Kasasa Saver are trademarks of Kasasa, Ltd., registered in the U.S.A.

Use this calculator to determine your projected earnings from our Kasasa Cash account. Move the sliders or type in the numbers to see your potential rewards.

- Estimated Annual Rewards $0

- Estimated monthly dividends earned* $0

- Monthly ATM fees refunded**$0

This calculator compares the costs of buying or leasing a vehicle. There are three sections to complete, and you can adjust and experiment with different scenarios.

- Net cost of buying $0

- Net cost of leasing $0

A fixed-rate, fixed-term Share Certificate can earn higher returns than a standard savings account. Use this calculator to get an estimate of your earnings. Move the sliders or type in numbers to get started.

- Total value at maturity $0

- Total dividends earned $0

- Annual Percentage Yield (APY)0.000%

Whether it's a down payment, college, a dream vacation...a savings plan can help you reach your goal. Use the sliders to experiment based on length of time and amount per month.

- Monthly deposit needed to reach goal $0

This calculator can help you get a general idea of monthly payments to expect for a simple loan. Move the sliders or type in numbers to get started.

- Estimated monthly payment $0

- Total paid $0

- Total interest paid $0

Auto Loans

| Term | Annual Percentage Rate | Payment Per $1000 |

|---|---|---|

| up to 60 months | as low as 4.79%* | $17.48 |

| up to 66 months | as low as 5.19% | $17.42 |

| up to 72 months | as low as 5.69% | $16.56 |

| up to 84 months | as low as 6.19% | $14.86 |

*4.99% on new loans, not eligible for in-house refinance - 5.49% for internal refi

Business Plus Checking

| Balance | Annual Percentage Yield (APY) |

|---|---|

| 0 - $2,499.99 | - |

| $2,500 - $49,999.99 | 0.65% |

| $50,000 - $99,999.99 | 0.75% |

| $100,000 - $149,999.99 | 0.85% |

| $150,000 - $249,999.99 | 0.95% |

| $250,000+ | 1.70% |

Business Savings

| Balance | Annual Percentage Yield (APY) |

|---|---|

| 0 - $2,499.99 | 0.05% |

| $2,500 - $49,999.99 | 1.05% |

| $50,000 - $99,999.99 | 1.05% |

| $100,000 - $149,999.99 | 1.15% |

| $150,000 - $249,999.99 | 1.25% |

| $250,000+ | 2.00% |

Home Equity Loans

| Term | Annual Percentage Rate | Payment Per $1000 |

|---|---|---|

| up to 60 months | as low as 5.49% | $19.27 |

| up to 120 months | as low as 5.79% | $11.16 |

| up to 180 months | as low as 5.99% | $8.64 |

| up to 240 months | as low as 6.49% | $7.62 |

IRA Share Certificates: $1,000.00 or Greater

| Certificate Term | Dividend Rate |

|---|---|

| 3 Month IRA Certificate | 3.00% |

| 6 Month IRA Certificate |

3.95% |

| 12 Month IRA Certificate | 4.10% |

| 18 Month IRA Certificate | 4.05% |

| 24 Month IRA Certificate | 3.85% |

| 36 Month IRA Certificate | 3.70% |

| 48 Month IRA Certificate | 3.50% |

| 60 Month IRA Certificate | 3.45% |

Membership Required. Rates subject to change without notice. $1,000 minimum opening deposit required. Only New money eligible for promotional rate. CD will auto renew at standard rate at maturity unless otherwise stated. Early withdrawal penalty will apply. Early withdrawals may result in penalties. Terms of less than 12 months lose 90 days’ interest. Terms 12 months to less than 36 months lose 180 days’ interest. Terms of 36 months or longer lose 270 days’ interest. The penalty will be deducted from earnings and may reduce principal balance. New money is defined as money not currently on deposit with Capitol Credit Union.

Kasasa Cash*

| Balance | Rate | APY |

|---|---|---|

| 0 - $15,000.00 | 5.84% | 6.00% |

| $15,000.01+ | 1.00% | 6.00% to 1.65% |

| All balances if qualifications not met | 0.05% | 0.05% |

Kasasa Saver*

| Balance | Rate | APY |

|---|---|---|

| 0 - $100,000 | 3.93% | 4.00% |

| $100,000+ | 1.08% | 4.00% to 1.00% |

| All balances if qualifications not met | 0.05% | 0.05% |

Lines of Credit/Credit Card

| Product | Term | Annual Percentage Rate | Minimum Payment |

|---|---|---|---|

| Personal Line of Credit | Revolving | as low as 10.99% | $25.00 |

| Visa Classic Credit Card | Revolving | as low as 10.99% | Greater of 3% of balance or $30.00 |

| Visa Capitol Rewards Credit Card | Revolving | as low as 11.99% | Greater of 3% of balance or $30.00 |

Non-collateralized Loans

| Term | Annual Percentage Rate | Payment Per $1000 |

|---|---|---|

| up to 60 months | as low as 10.99% | $21.41 |

| up to 72 months | as low as 11.99% | $19.17 |

| up to 84 months | as low as 12.99% | $17.72 |

Other Collateralized Loans (Boat, Motorcycle, Camper, ATV, Etc.)

| Term | Annual Percentage Rate | Payment Per $1000 |

|---|---|---|

| up to 60 months | as low as 7.29% | $20.04 |

| up to 72 months | as low as 7.79% | $17.54 |

| up to 84 months | as low as 8.29% | $15.84 |

| up to 120 months | as low as 8.79% | $12.67 |

| up to 180 months | as low as 9.29% | $10.45 |

Plus Money Market

| Balance | Annual Percentage Yield (APY) |

|---|---|

| 0 - $2,499.99 | - |

| $2,500 - $49,999.99 | 1.05% |

| $50,000 - $99,999.99 | 1.05% |

| $100,000 - $149,999.99 | 1.15% |

| $150,000 - $249,999.99 | 1.25% |

| $250,000+ | 2.00% |

Savings Accounts

| Account Type | Annual Percentage Yield (APY) |

|---|---|

| Savings Accounts | 0.01% |

| IRA Savings Account | 0.75% |

| Holiday Club Account | 0.10% |

Secured Loans

| Source | Annual Percentage Rate | Term |

|---|---|---|

| Share Account | 5.00% | up to 84 months |

Payment example: pay just $13.91/month for every $1000 borrowed at 5.00% APR on an 84 month term.

Share Certificates: $1,000.00 or Greater

| Certificate Term | Annual Percentage Yield (APY) |

|---|---|

| 3 Month Certificate | 3.00% |

| 6 Month Certificate | 3.95% |

| 12 Month Certificate | 4.10% |

| 18 Month Certificate | 4.05% |

| 24 Month Certificate | 3.85% |

| 36 Month Certificate | 3.70% |

| 48 Month Certificate | 3.50% |

| 60 Month Certificate | 3.45% |

Membership Required. Rates subject to change without notice. $1,000 minimum opening deposit required. Only New money eligible for promotional rate. CD will auto renew at standard rate at maturity unless otherwise stated. Early withdrawal penalty will apply. Early withdrawals may result in penalties. Terms of less than 12 months lose 90 days’ interest. Terms 12 months to less than 36 months lose 180 days’ interest. Terms of 36 months or longer lose 270 days’ interest. The penalty will be deducted from earnings and may reduce principal balance. New money is defined as money not currently on deposit with Capitol Credit Union.