Invest Smarter with CCU + Unifimoney

Capitol Credit Union is proud to partner with Unifimoney to bring our members a modern digital investment platform. This new partnership gives you access to tools that help you invest smarter and manage your finances more holistically all from one secure place.Whether you prefer to choose your own investments, have an automated professionally managed portfolio, or combine both, Unifimoney gives you the flexibility to invest your way. All with the same trusted service you've come to expect from CCU.

A Full Suite of Investment Options

From one secure platform, you can now invest in:

-

Stocks and ETFs – Trade directly and diversify your portfolio.

-

Cryptocurrency – Access major digital currencies in just a few taps.

-

Precious Metals – Invest in gold, silver, and more right from your phone.

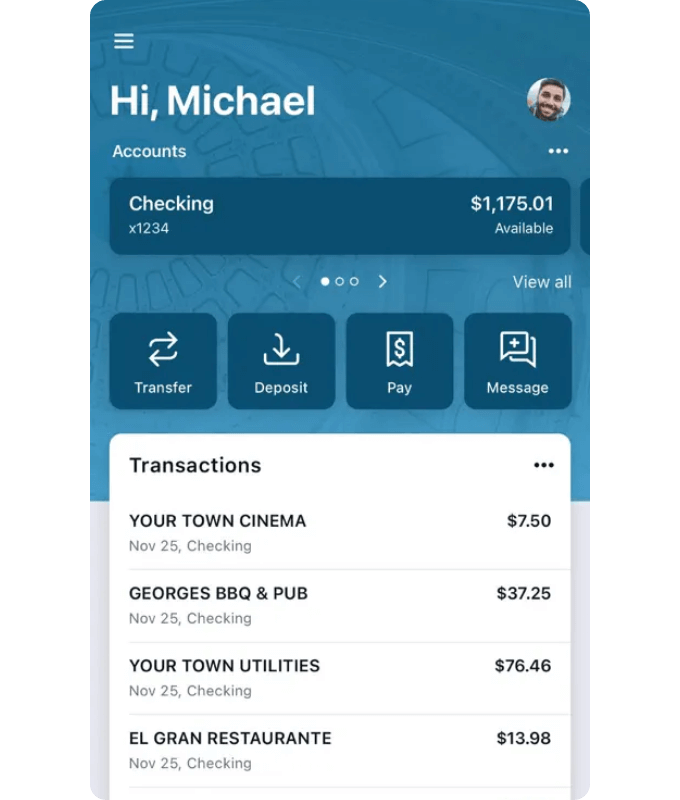

No need to download third-party apps or manage multiple logins. Everything is available within your existing CCU banking experience.

Flexible Tools for Every Investor

Whether you're actively managing your portfolio or prefer a more passive approach, Unifimoney has you covered. Use the automated Robo platform for a hands-off experience, or take control with self-directed trading. All backed by trusted financial technology and CCU’s local support.

Seamless, Secure, and Convenient

With Unifimoney embedded into your CCU digital banking, your finances and investments are always connected. It’s a smarter way to grow your money on your schedule, with zero added hassle.

Start investing the easy way only with Capitol Credit Union.

Log into your online banking to explore Unifimoney today.

*Offer valid for the first 50 Capitol Credit Union (CCU) members who successfully open and fund a Unifimoney investment account through the CCU app and complete their first trade of any amount during January 2026. Limit one bonus per customer. Bonus will be credited within 1-5 business days of qualification.

CCU membership required. Capitol Credit Union is not responsible for any loss of principal. Access to the program is exclusively available through the CCU mobile banking platform.

Investment Advisory Services offered through Unifimoney RIA QOBZ, LLC, an SEC-registered investment advisor, are not FDIC or NCUA insured, are not deposits or obligations of the financial institution, and may lose value. All Brokerage and Clearing services are provided by, and securities are offered through, Apex Clearing Corporation, Registered SEC, FINRA broker dealer and member SIPC. Banking services are provided by First Fidelity Bank, Member FDIC. Cryptocurrency services are offered through Gemini Trust Company; digital assets are not FDIC or SIPC insured. Precious metals offered via GBI are also not insured or guaranteed by any bank. Not all products are suitable for all investors. Please review our Form CRS and ADV filings, and visit www.unifimoney.com/legal for full disclosures and more information.

© 2025 Unifimoney Inc., All rights reserved.